Truck freight in the U.S. slipped slightly in September, but behind the numbers, industry analysts are spotting hints of a market shift that could benefit carriers in the coming months.

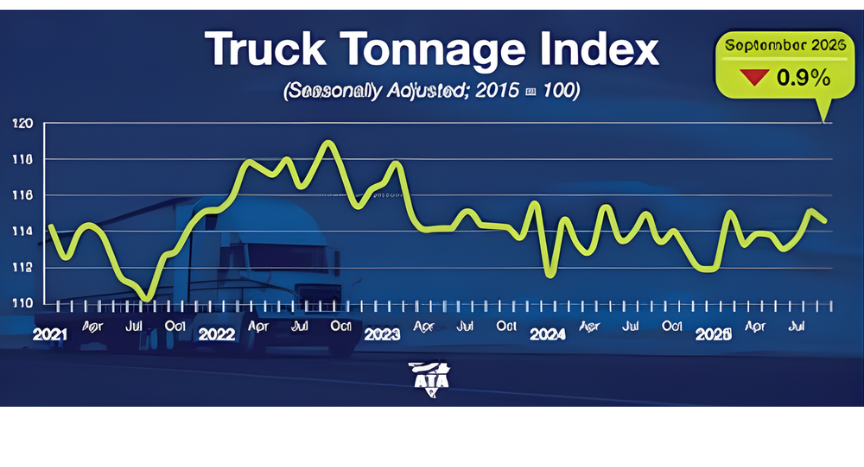

The American Trucking Associations (ATA) reported that its seasonally adjusted For Hire Truck Tonnage Index fell 0.9% in September to 114.2, down from 115.3 in August. While that drop erased gains from earlier in the summer, tonnage is still 0.8% higher than September 2024, showing slow but steady improvement over the past year.

ATA Chief Economist Bob Costello said the data highlights just how uneven freight conditions remain.

“Tonnage levels remain choppy, but they are up 2.1% since hitting a low in January. Compared to the high three years earlier, however, truck tonnage is still off by 3.9%. In fact, September’s tonnage level was essentially the same as in September 2023, underscoring the tough freight market over the last few years,” Costello said.

Market Signals Are Shifting

Even though tonnage slipped, other signs suggest the market could be turning. FTR’s Trucking Conditions Index (TCI) rose to a nearly neutral 0.3 in August after sitting at -1.03 in July. The TCI measures key factors like freight volume, rates, capacity, fuel prices, and financing costs to gauge the overall health of the market.

FTR said the latest gain came “primarily due to less challenging freight rates,” noting that while utilization improved slightly, it was not a major driver of the index change.

Looking ahead, FTR projects better conditions in 2026 and 2027, even though near-term readings will likely stay close to current levels.

Capacity Tightening Could Lead to Recovery

One of the biggest potential drivers of market recovery may come from tightening capacity. Avery Vise, vice president of trucking at FTR, said restrictions on issuing and renewing commercial driver’s licenses (CDLs) for foreign drivers could impact fleet capacity.

“The potential for a capacity-driven recovery in trucking has risen over the past month due to severe restrictions imposed on issuing and renewing commercial driver’s licenses for foreign drivers,” Vise said. “However, despite some anecdotal reports about various effects of a crackdown on immigrant drivers, available data has yet to show a substantial impact on market conditions.”

Vise previously noted that the FMCSA’s non-domiciled CDL rule could push roughly 194,000 CDL holders out of the market over two years, a shift that might recreate the tight utilization levels seen in 2021.

“This would be very good for carriers, not very good for shippers,” he added.

Vise also pointed out that stepped-up enforcement from U.S. Immigration and Customs Enforcement could add even more pressure on capacity, though the full impact is still unclear.

“We expect pressure on foreign drivers to be a significant factor for capacity in the coming months, but many questions remain about the scope and speed of the tighter CDL and English language enforcement on the truck freight market,” he said.

Equipment and Driver Supply Getting Tighter

Tim Denoyer, vice president and senior analyst at ACT Research, said the driver market is no longer oversupplied but not yet tight. According to ACT’s Driver Availability Index, a reading below 40 typically precedes rate increases, and the index is approaching that threshold again.

“The new rules on non-domiciled drivers could tighten driver capacity over the next one to two years, but heavy truck tariff costs are starting to constrain equipment capacity,” Denoyer said.

Class 8 production data backs that up. Denoyer noted that tractor builds are expected to fall roughly 35% in the second half of the year, dropping several thousand units per month below what fleets need to maintain size.

ACT Research believes that reduced capacity combined with steady freight demand could speed up the next market cycle and lead to new for-hire opportunities.

However, Denoyer cautioned, this recovery will not happen overnight. “This transformation will take time,” he said.

For drivers and carriers who have weathered the slow freight cycle, these tightening conditions may signal that a long-awaited rebound is finally taking shape, one load at a time.

Image Source: Commercial Carrier Journal, ATA

Source: Commercial Carrier Journal