The freight industry is grappling with a significant truck driver shortage, estimated at 24,000 unfilled positions, which is leaving many trucks unused. According to altLINE’s latest report, this shortfall results in weekly losses of $95.5 million for the industry.

If all registered trucks were active, the industry could generate an additional $47.4 billion annually, underscoring how costly this issue truly is.

The Scale of the Driver Deficit

The altLINE report analyzed data between November 22 and December 5, 2024, covering truck driver roles on Google for Jobs and salary statistics from platforms like LinkedIn, Indeed, Glassdoor, ZipRecruiter, Monster, and others.

While thousands of listings were found online—28,515 job postings specifically—the data revealed that the online job market captures only a fraction of available positions. A study by Zippia showed that just 25% of truck driving positions are advertised online, with most (70%) being filled through staffing firms, personal networks, and offline recruitment efforts.

On average, 7,213 trucking positions were advertised daily during the study period. This points to an enduring shortfall of around 24,043 drivers.

Jennifer Fink, Freight Factoring Operations Manager at altLINE and the report’s lead researcher, shared that “Multiply this by the reported $3,971 revenue per week for every truck that is not being manned, and we arrive at the true cost to the freight industry – $95.5 million every single week.”

Economic Potential of Fully Utilizing Trucks

The study also explored the economic potential if the trucking sector were to fully utilize its existing fleet. Using census data, it highlighted the disparity between available trucks and professional drivers.

For example, there are more than three times as many registered tractor trucks as hired drivers. Factoring in approximately 10.5 million additional heavy trucks in the U.S. magnifies the issue of unused equipment.

While straight trucks generate slightly less revenue per week than tractor trucks, their sheer numbers amplify the problem. Combined, this contributes to an additional $39.9 billion in estimated annual losses due to idle straight trucks—bringing the total weekly losses to nearly $50 million across all truck types.

“This number is merely hypothetical, but it is powerful in demonstrating the huge discrepancy in truck availability between truckers and drivers,” Fink said. “Millions of trucks sit idle in the U.S. every day, and each one represents a missed opportunity and losses for the freight industry and many more losses further down the supply chain.”

Regional Insights

Regional disparities also play a major role in the driver shortage crisis. Missouri tops the country for trucker demand, with approximately 202 job postings daily. Given that 70% of trucking positions remain unadvertised, the report estimates there are around 673 open roles in Missouri at any time.

Wyoming has the highest demand relative to its population, with one open trucker position per 1,031 residents. Meanwhile, Texas—despite its prominence in interstate trade—ranks fifth for overall driver vacancies. However, when adjusted for population, Texas shows a comparatively low trucker-to-job demand ratio, making it one of the most competitive states for securing drivers.

Nebraska stands out for its surplus of truckers, leading the nation in the speed of filling trucking roles.

Job Turnover and Recruitment Speed

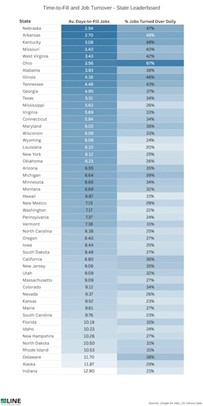

The time it takes to fill truck driver jobs varies greatly across regions, highlighting local freight industry dynamics. Ohio boasts one of the quickest markets, with two-thirds of advertised truck driver jobs being filled or replaced daily. This results in an average recruitment time of just 3.6 days.

Nebraska excels even further, with an average hiring time of just 2.5 days, though this rapid rate is accompanied by a job turnover rate of 47%, indicating a significant backlog of unfilled positions.

At the opposite end of the spectrum, Indiana has the slowest-moving trucker job market. With a daily turnover rate of just 21%, it takes nearly two weeks to fill positions, making it the most challenging state for addressing trucking vacancies.

The Bigger Picture

The truck driver shortage is not just a trucking industry problem; it sends ripples down the entire supply chain, causing inefficiencies, delays, and financial losses. Bridging this gap will require tackling key issues, including improving working conditions, increasing job visibility, and leveraging both offline and online recruitment strategies.

Source: Commercial Carrier Journal